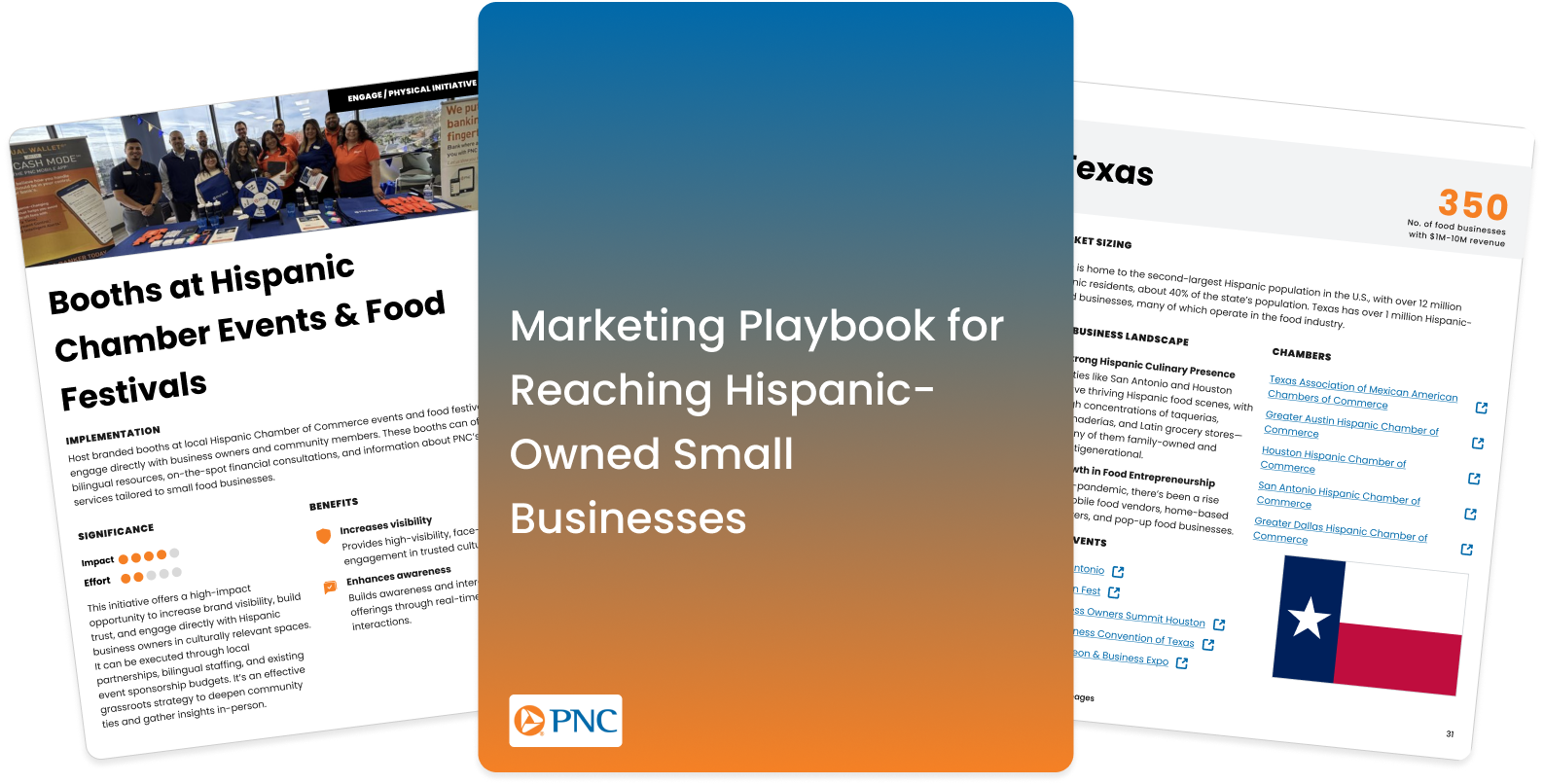

Making PNC the Bank of Choice for Hispanic Small Business Owners

12-week research sprint for PNC Bank's SMB strategy

AT A GLANCE

OVERVIEW

OUTCOME:

Delivered a go-to Marketing Playbook + roadmap that translates insights into action, including: community pop-ups, Spanish-speaking teller coverage, quick loan calculator, and financial literacy workshops, with success metrics defined.

Projected impact: ~$1.5M annual revenue and a shift to relationship-driven growth.

ROLES AND METHODS:

40+ discovery interviews with Hispanic/Latino SMB owners, chambers of commerce, and banking SMEs

Field visits / contextual inquiry in shops and food venues to capture real workflows and trust signal

JTBD mapping + 5Es journey (Entice → Enter → Engage → Extend) to locate friction and opportunity across the lifecycle

Competitive analysis (Banco Popular, Chase, BoA vs. PNC) to benchmark cultural fluency, onboarding, and tools

Tool walkthrough, think aloud, qualitative interviews for testing

Market sizing & pilot selection (Texas) based on overlap of demand and PNC distribution

ROLE

Lead UX Researcher

Mixed Methods Strategist

TEAM

4-person interdisciplinary team (research, service design, strategy, ops)

TIMELINE

Jan – Jun 2025 (6 weeks)

SKILLS

Prototyping

Product strategy

CHALLENGE:

First-time Hispanic/Latino founders can’t find a bank that feels like a partner.

Why it matters:

Food & Beverage is a top 3 sector for first-time founders

Trust and cultural fluency are the biggest barriers

Lack of bilingual support limits access

Texas is a strong fit to pilot and test solutions: